Underlying Tones From the October USDA Report

Nov 06, 2024

Zack Gardner

Grain Marketing & Origination Specialist

AT FACE VALUE, the October report was neutral. The USDA raised corn yield by 0.2 bu/acre and lowered soybean yield by 0.1 bu/acre. Pretty small changes to U.S. production, which was on par for the typical “nonevent” that is the October USDA report. BUT … I picked up on some interesting underlying tones for long-term direction.

Soybeans

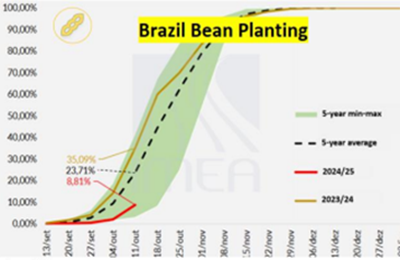

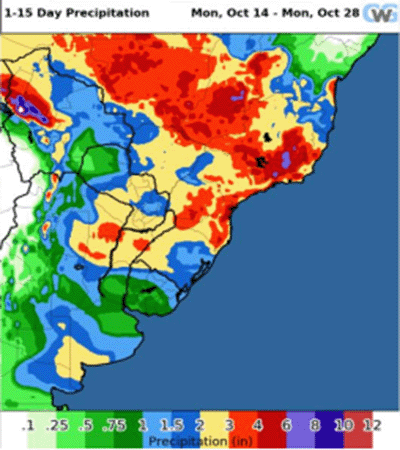

I’ll keep this section short as I’m beating a dead horse after my last two newsletter articles, where I was quite bearish on soybeans. In the October 11 USDA report, Brazil’s soybean production estimate was the same as the month before: 169 MMT. This means our own USDA isn’t buying into the Brazilian drought story and is still estimating the same record crop they did last month, which is 16 MMT (587 million bushels) larger than last year’s crop. Then on October 14, CONAB (Brazil’s USDA) came out with their estimate on the Brazilian bean crop: 166 MMT, which is a little lighter than the USDA but still a record. At this same time, Brazil started having rain events, with more expected for the extended 15-day forecast.

Corn

This is where things get a little interesting and my bearishness ends! Here are a few key figures from the October 11 report that I think were missed by the majority:

So how bullish should we get? An extra 169 million in corn exports would take our current carryout from 1.839 billion down to 1.67 billion, or from a stocks-to-use ratio of 12.2 percent to 11.0 percent. In my opinion, a stocks-to-use ratio below 10 percent is bullish, but bringing it down to 11 percent is much more friendly than where we’re at today. You may call me crazy, but if this potential corn export program materializes, I don’t think $4.50 corn next summer is out of line.

Before we get too bullish, here are some things to question:

Grain Marketing & Origination Specialist

AT FACE VALUE, the October report was neutral. The USDA raised corn yield by 0.2 bu/acre and lowered soybean yield by 0.1 bu/acre. Pretty small changes to U.S. production, which was on par for the typical “nonevent” that is the October USDA report. BUT … I picked up on some interesting underlying tones for long-term direction.

Soybeans

I’ll keep this section short as I’m beating a dead horse after my last two newsletter articles, where I was quite bearish on soybeans. In the October 11 USDA report, Brazil’s soybean production estimate was the same as the month before: 169 MMT. This means our own USDA isn’t buying into the Brazilian drought story and is still estimating the same record crop they did last month, which is 16 MMT (587 million bushels) larger than last year’s crop. Then on October 14, CONAB (Brazil’s USDA) came out with their estimate on the Brazilian bean crop: 166 MMT, which is a little lighter than the USDA but still a record. At this same time, Brazil started having rain events, with more expected for the extended 15-day forecast.

Corn

This is where things get a little interesting and my bearishness ends! Here are a few key figures from the October 11 report that I think were missed by the majority:

- Corn yield was increased by 0.2 bu/acre, but was offset by a 25 million bushel increase in U.S. corn exports.

- Ukraine’s corn production was lowered to 26.2 MMT, compared to 32.5 MMT last year (248 million fewer bushels in production).

- The USDA lowered China’s corn import figure from 21 MMT to 19 MMT (a 78.7 million bushel reduction).

So how bullish should we get? An extra 169 million in corn exports would take our current carryout from 1.839 billion down to 1.67 billion, or from a stocks-to-use ratio of 12.2 percent to 11.0 percent. In my opinion, a stocks-to-use ratio below 10 percent is bullish, but bringing it down to 11 percent is much more friendly than where we’re at today. You may call me crazy, but if this potential corn export program materializes, I don’t think $4.50 corn next summer is out of line.

Before we get too bullish, here are some things to question:

- Does paying nine months of commercial storage ($0.63) to capture a $0.50 rally make sense? Could this be better done with an approximately $0.25 options strategy?

- If Brazil oversupplies the world on beans and they have $8 in front of them come spring, will there be more growers looking to plant $4 corn than $8 beans? Could the February/March planting estimates keep a lid on future corn rallies?